Sorting Out Your Finances

Tips to Help Parents Organize a Savings Plan: A Guest Post by Sara Bailey

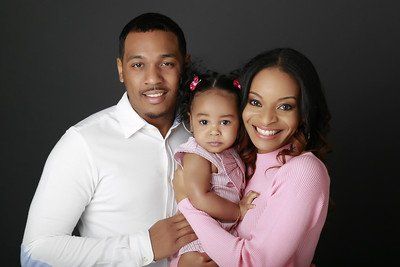

Something weighing heavily on my mind lately is the fact that more than 75 percent of Millennial parents don’t have life insurance and that barely half of these have a will. As a now-single mother and widow, I found out the hard way why having a solid financial plan in place is crucial, regardless of age. Part of the healing process for us was to regain financial traction, but it was hard, and there were times when I was angry that it wasn’t taken care of before. I hope that the following advice will save someone else the heartache we endured.

For many parents, thinking about finances and saving money might induce stress and anxiety; it’s hard to think about the future when there are so many other important things happening in the present. Raising a child is a huge job, and for new parents , there are lots of details and new experiences that come along with it that override thoughts of money.

However, it’s important to start planning as early as possible for your financial comfort, as life will throw many curveballs your way over the years. From home maintenance to school expenses, there are many things that could drive up your debt and derail your savings plan.

Also, start thinking about a plan for your family after you’re gone. While no one wants to think about end-of-life preparations, doing so now will help your loved ones immeasurably in the event of your death, giving you peace of mind that they’ll be taken care of no matter what happens. Keep reading for some of the best tips on how to start stress-free financial planning.

Educate yourself

It can be difficult to know where to begin with planning if you’re unfamiliar with certain terms or the best way to save, so do some research. Talk to your bank about the best savings accounts for college and exactly what they entail. For instance, one plan may require that all the money in the account be used within a certain time frame, or that it only be used for college, meaning that if your child decides to travel the world instead, he can’t withdraw the money and use it to fund his trip. Getting educated about your finances will not only help you have a better understanding of how to prepare, but it will also help reduce your stress throughout the process.

Update your insurance

Being a new parent is scary because it’s so easy to think about all the things that could happen, from car accidents to illness. Updating your health and life insurance policies will ensure that your loved ones are taken care of no matter what happens, and you will be covered in the event of an accident or illness. During this time, you should also decide whether a pre-paid funeral plan is something worth looking into; considering that the average funeral in the US costs around $8,508 , taking care of this expense ahead of time will take some of the burdens off your family’s shoulders. Additionally, it’s also a good idea to look into creating a living will.

Calculate your worth

All good financial planning starts with a basic rule: Know your worth. Adding up all of your investments and assets will give you a good idea of where to begin when you start thinking about college funds and retirement, and since one of your biggest investments is your home, you’ll want to find out how much it’s worth.

Create a savings plan

Not only is it important to figure out how to save in the long-term--for college, for instance--it’s a good idea to start learning how to save money in the short-term and on a daily basis. You might start cooking more often than you eat out, carpool to save money on gas and supplement your income by selling gently used clothing and accessories on apps such as Vinted and Poshmark. While it may seem like these saving tactics aren’t doing much, they can help you save quite a bit of money if you stick with them.

Figuring out your finances and learning how to save will give you peace of mind, both now and later in life. With a good savings plan, you and your loved ones will feel secure and safe no matter what comes your way.

From time to time we will bring you guest posts on topics of interest.

Please note that blog posts do not constitute legal advice, but are intended for informational purposes only. They cannot substitute for an in-person consultation with a lawyer. Your use of this site does not create an attorney client relationship.